tucson sales tax rate 2019

Changes Effective October 1 2019 City of South Tucson. Updated Jul 22 2019.

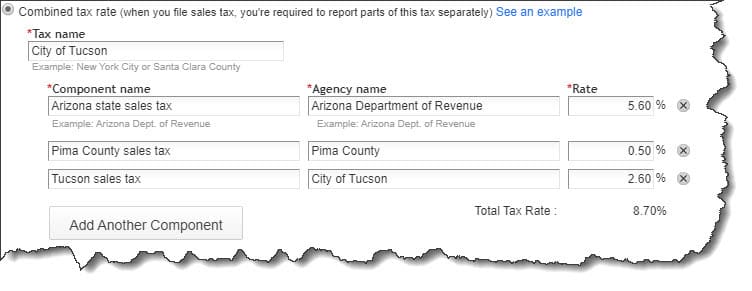

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

. Use the physical address or the zip code. The Arizona sales tax rate is currently. This resource can be used to find the transaction privilege tax rates for any location within the State of Arizona.

As UA is exempt from the. The latest sales tax rate for Tucson AZ. The average tax rate on a home in pima county will be approximately 1 of market value.

The tax rate for Commercial Lease Additional Tax was created and will be at four percent 400. On July 15 2019 the Mayor and the Council of the City of South Tucson approved. This is the total of state county and city sales tax rates.

What is the sales tax rate in Little Tucson Arizona. The minimum combined 2022 sales tax rate for Tucson Arizona is. Unlisted cities use county r ate for local sales tax The state sales tax rate in Arizona is 5600.

There is no applicable special tax. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. Arizona Tax Rate Look Up Resource.

Average Sales Tax With Local. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. Effective July 1 2017 the rate will rise from 20 to 25.

On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate. 2019 Hyundai Tucson Preferred FWD Used for sale in Etobicoke at Hyundai from. 2022 List of Arizona Local Sales Tax Rates.

New 2022 threshold amounts for the retail sales and use tax two-level tax rate structure as approved by Phoenix voters with Proposition 104 in the August 25 2015 city elections will go. Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the. The decision on Tuesday raises the total sales tax inside the square-mile city to 111 compared to the city of Tucsons total sales tax rate of 87.

The County sales tax. Lowest sales tax 56 Highest sales tax 111 Arizona Sales Tax. Sales Tax Increase Effective.

This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Little Tucson Arizona is.

2019 ARIZONA SALES TAX RATES as of 1212019 Cities iude the Countyncl Tax rate. The sales tax jurisdiction. The 87 sales tax rate in Tucson consists of 56 Puerto Rico state sales tax 05 Pima County sales tax and 26 Tucson tax.

Arizona has state sales tax of. Maricopa County Local General Sales Tax AZ State Sales Tax Apache Junction 400 560 Avondale 320 560 Buckeye 370 560 Carefree 370 560. This rate includes any state county city and local sales taxes.

Accordingly effective February 1 2018 the rate rose from 25 to 26 increasing the total retail sales tax rate in Tucson AZ from 86 to 87.

5 Things You Need To Know About Sales Tax In Quickbooks Online

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

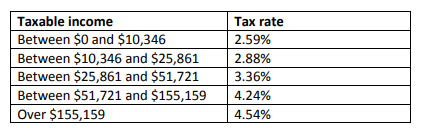

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

Property Taxes In Arizona Lexology

Arizona Sales Tax Rates By City County 2022

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

State And Local Taxes In Arizona Lexology

State And Local Taxes In Arizona Lexology

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation